Today, we’re going to explore Skrill, a reliable and secure payment processor that allows you to manage your online transactions with ease. Not only is it user-friendly, but it also offers competitive commissions that make it an attractive choice for many users.

In this article, we’ll cover how Skrill works and the fees it charges. We’ll also guide you through the process of verifying your cards and account, how to deposit funds, and how to withdraw money efficiently. To wrap up, I’ll share my personal opinion about the platform.

I’ve been using Skrill for quite some time now, and I can confidently say that it’s worth considering — especially if you engage with online earning platforms like Clixsense or Neobux. In fact, Skrill serves as an excellent alternative to PayPal. It offers reasonable fees, robust security, and a user-friendly interface, making it a payment processor you can rely on without hassle.

It’s also important to mention that Skrill is accepted by a wide range of online merchants and virtual stores. Personally, I often use it to make online purchases and to withdraw earnings from various platforms I work with.

Enter here: www.skrill.com/

What is Skrill and how does it work?

Skrill is a widely used global payment processor, similar to PayPal. The platform originally launched as Moneybookers in 2002 and was rebranded as Skrill in 2011. As you can see, it has been a trusted player in the online payments industry for many years, standing alongside PayPal from the early days.

When you create an account on Skrill, it is linked to your email address, just like with most other payment processors. This allows you to easily send and receive money through this online wallet.

One of the great advantages of Skrill is that you can withdraw your funds to your bank account smoothly — without unnecessary complications. Unlike some other processors that make you jump through hoops or charge excessive fees just to access your own money, Skrill offers a straightforward withdrawal process to both your bank account and/or card.

create our account

To register on Skrill, simply click the link to the official website and sign up:

Fill in the required fields with your personal information — the usual steps.

One important detail to keep in mind is selecting the currency you will use for your account. It’s essential to be certain about this choice because, once your account is created, you won’t be able to change the currency later. If you typically operate in US dollars, be sure to select the dollar option. This will help you avoid currency exchange fees in future transactions.

Also, make sure to enter your real information. This is crucial for preventing issues down the line when using the platform — starting with your email address. Skrill will send a confirmation email to verify your email address.

Once you receive this email, simply open it and click on the provided link. After this step, your email will be confirmed (note that this is different from a fully verified account).

Add card or bank account

After verifying your email, the next step is to link a credit card or bank account to your Skrill account. Using a credit card is usually faster, though it does come with higher fees.

You’ll need to complete the form with your card details. In my case, I typically use an Advcash virtual card, which works well for me. However, I recommend using a VISA card if you have one, as the fees are lower — 1.9% with VISA compared to 2.25% with MasterCard.

Once you've added your card, the final step is to verify it, which involves a few simple and quick step

How to verify a Card or Bank Account

Once you have your card or bank account linked to Skrill, you can proceed to verify them by navigating to the “Verify” section.Be sure to select the option “No games or bets” if you do not intend to use Skrill for gambling purposes. Next, click on “Amount due and verify”. A new screen will appear, instructing you to check your linked account for a small charge that Skrill has made — this is part of the verification process.

To complete the verification, access your bank account or card account that you linked. Look for the transaction amount Skrill used for verification.

Once you locate it, simply enter the exact amount into Skrill — and that’s it! Your card is now verified. Keep in mind that it may take a little time for this verification charge to appear in your account.

How to load our account

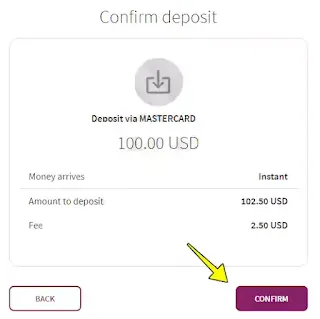

To fund your Skrill account, click on the “Load” option located beneath your account balance.

Next, select your preferred funding method. In my case, I typically choose Debit/Credit Card:

Load Account - Step 2

Once you complete the process, you’ll receive a confirmation message on your mobile phone to authorize the transaction.

Shortly after, the transaction should appear in your account balance — and you’re all set!

How to withdraw money from Skrill

You have two options to withdraw money from your Skrill account:

Send Money: You can send money to another Skrill account for free. The transaction is instant — simply enter the email address of the recipient and the amount you wish to send. (Note: This option is only available for transfers between Skrill accounts.)

Withdraw: You can also withdraw your funds to either a bank account or a VISA card.

To do this, click on the “Withdraw” option.

Then, choose your preferred withdrawal method — either via VISA card or bank account. In this example, we’ll select a VISA card:

After filling out all required fields, you will need to verify your card to complete the process.

Important: Skrill will send you a 4-digit code that will appear in the transaction details of the withdrawal you’ve made. You’ll need to verify the withdrawal by locating this code in the transaction on your VISA card or bank account statement.

Be aware that this process can be a bit slow, so don’t worry if it takes a few days for the transaction and the code to appear. Just be patient — this is perfectly normal.

Verify Skrill Account

- Limit per transaction: €1,000

- Maximum account balance: €2,500

- Maximum refund: €1,000

To begin the verification process, simply complete any transaction. After performing a transfer, you’ll see a notification in an orange box inviting you to verify your account.

Next, you’ll need to select the type of document you wish to upload for verification.

skrill commissions

Skrill’s commissions can vary depending on the country you’re located in. To get the most accurate information, you can check the Skrill commissions specific to your country on their official site.

Here’s a quick overview of the main fees and commissions that Skrill applies:

Commissions for loading the account:

Here I leave all the Skrill commissions to load/add money to our account:- By bank transfer: 0%

- RapidTransfer: 0.50%

- Top up with Bitcoins: 1%

- Fast Bank Transfer: 1,50%

- immediate transfer: 1.90%

- Trustly: 1,95%

- Neteller: 3.00%

- Swift Transfer: 0%

- Visa card: 1.90%

- MasterCard: 2,25%

- Paysafe card: 7.50%

The only downside is that the transfer can take 3 to 5 days to arrive. If you’re not in a hurry, this method is a reliable option for moving money to your account.As you can see, the best way to add funds is through Bank Transfer.

Commissions for withdrawing money:

- Bank transfer: €5.50

- VISA card: 7.5% of the amount

- SWIFT transfer: €5.50

One advantage is that the fixed fees for bank and SWIFT transfers (€5.50 per transfer) allow you to send larger sums without extra percentage charges. This makes it cost-effective if you plan to transfer significant amounts at once.

Skrill prepaid card

Skrill offers a prepaid MasterCard, which can be very useful if you want to withdraw money from ATMs or perform other card transactions.

Since it’s a prepaid card, you don’t need to have a bank account, keeping your bank details completely secure.

The Skrill card carries an annual fee of €10 and has a transaction limit of €1,000 per operation.

Typically, the card takes about two weeks to arrive. Once you receive it, simply activate it through your Skrill account.

Please note, the Skrill prepaid card is only available in Europe.

Opinion about skrill Is it safe and reliable?

It’s clear that Skrill is a secure and reliable payment processor. Its many years in the industry speak volumes about its trustworthiness.

As a payment processor, Skrill performs quite well. One of its advantages is that it allows you to make direct purchases online, whether in various e-commerce stores or service platforms.

While the commissions are slightly lower compared to some other platforms, the difference isn’t dramatic.

In summary, Skrill is a great option for withdrawing money from websites like Clixsense or Neobux.

Positive Aspects

- You can operate your account without verifying it, avoiding the usual hassle seen on other platforms.

- Skrill offers an interesting affiliate program, giving you the chance to earn a bit extra by sharing your referral link.

- The platform is easy to use, with a clearer interface than many other payment processors.

- I’ve contacted their customer support via ticket several times and received quick responses (usually within one working day). This level of service is common among well-established payment platforms.

- Skrill also provides a mobile app, allowing you to manage your account and transactions conveniently on the go.

While Skrill’s commissions are lower than some other processors in certain cases, I still find them to be relatively high. To truly compete with PayPal, Skrill still has a long way to go.

There are some steps in the process that aren’t very clear, especially around account verification. It almost feels like Skrill doesn’t want you to verify your account until they decide to allow it. Wouldn’t it be easier if the verification process was straightforward from the start?

When it comes to withdrawing money, Skrill only supports bank transfers or VISA cards. Unfortunately, if you want to withdraw to a MasterCard like I do, you’re out of luck — which is disappointing.

Another drawback is that the Skrill prepaid card is only available to users in European countries, limiting its accessibility.

In summary, Skrill is a practical solution for paying and withdrawing money from sites like Clixsense, Neobux, or other platforms that accept Skrill. While its fees are noticeably higher than PayPal’s, it remains one of the few viable alternatives on certain websites.

[email protected]