Investors often make investment decisions based on fundamental analysis or technical analysis. This article will answer the following question: What is technical analysis?

Technical analysis is a very broad concept. The basic definition of technical analysis is that it is a set of techniques that aim to predict future price movements based on past price or volume changes.

Technical analysis is a universal tool, it can be used on the stock market, the commodity market or Forex. According to supporters of technical analysis, price changes in the market follow patterns that can be observed and analyzed.

Technical analysis is a very broad concept. The basic definition of technical analysis is that it is a set of techniques that aim to predict future price movements based on past price or volume changes.

Technical analysis is a universal tool, it can be used on the stock market, the commodity market or Forex. According to supporters of technical analysis, price changes in the market follow patterns that can be observed and analyzed.

Technical analysis – A type of chart

Many technical analysts and traders who use this type of market approach analyze price movements using stock charts. Each graph carries different information. The most popular stock charts include:

- Line – The simplest type of stock chart. The only information the chart displays is the closing price. This is one of the best known but rarely used types of stock charts;

- Bar – This is a type of chart called an OHLC (open, high, low, close). By design, it displays much more information than a line chart. The bar chart synthetically shows the entire range of price fluctuations (from the minimum to the maximum). This allows you to find support and resistance levels more accurately;

- Symbolic Dot Chart: The chart presents the struggles of supply and demand in a simplified way. The chart does not take into account the passage of time, it only tells you about price changes. This method uses two letters: X (demand) and O (supply);

- Candlestick or candlestick chart: This is one of the most popular types of stock charts. This type of chart comes from Japan and was invented in the 18th century. The candlestick chart also shows the closing price, open price, high and low. Most of the time, a rising candlestick has a white body and a bearish candlestick has a black body;

- Renko Charts – This is another type of chart created by the Japanese. The Renko chart ignores the passage of time. It consists of bricks that are formed after increasing by a certain amount.

Traders who apply technical analysis try to identify the trend of a given instrument. As a general rule, trends are divided according to their duration and direction of movement. In the case of time, technical analysis breaks down the trend into:

- Short Term – This is a secondary move to the medium term trend. As a rule, it lasts less than 3 weeks;

- Medium Term – This is a secondary trend to long-term traffic. As a rule, it lasts from 3 weeks to 3 months;

- Long-term: According to Dow theory, it should last at least a year. However, you can find trends that last for several years;

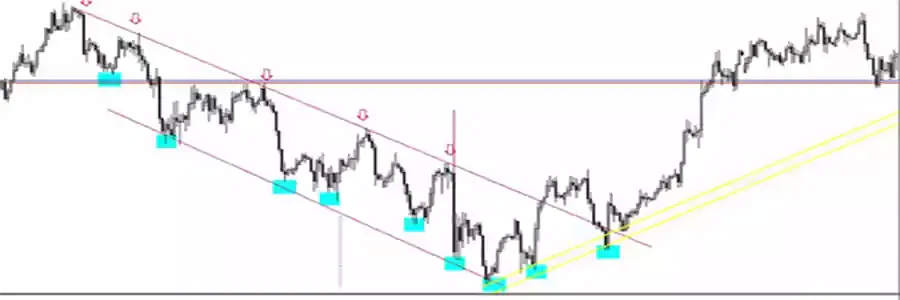

Due to the direction of price changes of a financial instrument, there are three types of trend:

- Uptrend – This is the type of price movement that shows higher and higher highs and lows. In the opinion of supporters of technical analysis, this shows that the demand side has the advantage and there is a greater probability that the uptrend will continue;

- Decreasing – This is the type of price movement that shows lower and lower highs and lows. In the opinion of supporters of technical analysis, this shows that the supply side has an advantage and there is a higher probability that the downtrend will continue;

- Side – This is the type of market situation where the supply and demand sides are in relative balance. As a result, the price of a given instrument gives the impression that it moves "from gang to gang." Investors who play with the trend wait for the price to break out (up or down) from the consolidation zone.

Technical analysis – Trend analysis

Technical Analysis – Formations

Part of technical analysis deals with looking for market structures in the market that will herald a continuation or reversal of the current trend. These market structures include:

- Continuation and trend reversal patterns;

- candle formations;

Analyzing a chart based on price patterns requires precision, patience, and consistency. At the same time, pattern analysis can be combined with other types of technical analysis - indicators or trend analysis.

Technical Analysis – Ichimoku Technique

One type of technical analysis is the Ichimoku technique. This type of chart analysis is from Japan and is not well known to the average trader. It is worth remembering that the beginnings of Ichimoku-based analysis date back to the 1930s. The Ichimoku technique is a comprehensive way of looking at the market.

Many users of this strategy do not use other types of tools (for example, analysis of patterns or indicators). However, it must be remembered that the type of technical analysis mentioned requires knowledge of a series of components, which are: Ichimoku Cloud, Tenkan-sen, Kijun-sen, Senkou span A and Senkou span B.

Knowing all the dependencies formed by the individual components makes the entry threshold relatively high. For this reason, many traders, after an initial fascination with the Ichimoku technique, abandon it in favor of simpler solutions.

Technical Analysis – Ichimoku Technique

harmonic formations

Harmonic patterns are part of technical analysis based on the shape of price patterns. As in the case of the classics, harmonic patterns can be identified by the way they "draw" when prices change. However, for the price pattern to become harmonious, certain conditions must be met.

Formations must comply with the appropriate dependencies between the individual segments of the formation (based, among others, on Fibonacci levels). It is very rare to see a perfect harmonic pattern. Very often, the forms of the training deviate slightly from the "book dependencies".

However, once a pattern is formed, there is a relatively high probability of getting a positive result from the pattern. At the same time, the patterns harmoniously and accurately represent the moment to take a position and the target point of the end of an ascending or descending wave.

Harmonic patterns include:

- AB = CD;

- Gartley;

- Butterfly;

- Whip;

- Crab;

price action

Price Action is a technical market analysis system that only uses price chart changes. Based on the price analysis, the trader can read possible trading signals. This type of technical analysis does not use indicators, oscillators, or Fibonacci retracements. It is because of its simplicity that this type of technical analysis is very popular among investors.

Price Action is an in-depth price analysis technique. Very often this type of technical analysis uses candlestick and price analysis. Investment decisions are made based on observing price changes.

price action

Technical analysis – Fibonacci

The Fibonacci number sequence has also found application in technical analysis. The most popular use is for Fibonacci (fibo) retracements, which many traders place on the chart to find possible turning points.

Fibonacci levels can be used to analyze stocks, commodities, and the forex market. There are many famous traders who profit from Fibonacci retracements. They include traders like Robert Miner, Bryce Gilmore, and Scott Carney.

Traders can use the Fibonacci sequence in chart analysis to:

- Determine potential resistance and support;

- Places to set possible defense orders and take profits.

Gann's theory

Gann theory is a type of technical analysis that involves linking time and price. As a result, a trader using this type of market view must carefully analyze not only the price change, but also the time since the price change.

Gann theorists suggest that the individual components of the theory should be combined with each other. As a result, Gann fans, Gann squares, and Gann cycles should be used simultaneously for market analysis. One should not be selective about the application of the theory. This can cause false signals to be generated.

Gann's theory has both supporters and detractors. Proponents argue that high rates of return can be achieved using this theory. On the other hand, opponents of the theory mention that it has more to do with numerology than with an investment strategy. However, it is worth checking out for yourself the effectiveness of Gann's theory.

Gann's theory

Dow's theory

The Dow theory is based on the assumption that the entire market, expressed in market averages, can present the condition of the market situation. As a result, it can be concluded that stock averages discount everything and that market manipulations are not sustainable in the long run.

Supporters of the Dow theory believe that by analyzing the current market condition, it is possible to identify "reference scenarios" with some certainty. Thus, the determination of the market condition can be compared to the definition of the "weather" that prevails in the stock market.

Technical Analysis – Indicators

Index analysis is a type of technical analysis that focuses on analyzing the price based on special patterns that make up the indicators. Indicators can be divided into market power analysis (momentum – ACC), volume analysis (OBV) or time and price interpretation (for example, SAR).

When analyzing an indicator-based instrument, remember that you need to know its structure in order to understand the strengths and weaknesses of the indicator. Some traders combine indicator analysis with other "splits" of technical analysis (eg trend, pattern, Elliot waves).

[email protected]